clubname.ru Learn

Learn

Can A Eviction Notice Be Handwritten

Commonly, service of process can be made by an adult over Thus, in many states, the landlord, an attorney, a paralegal, or even a friend or family member. You can fax it to their office and print out a fax confirmation sheet, or you can hand deliver it to their office. Ask them to date and sign for it and note the. My mother was given a hand written eviction notice. Most of the letter is illegible. It is instructing her to leave by the end of the month, but was given to. An eviction notice must be in writing. Legally, it cannot be delivered to you orally and constitute appropriate notice. This is true even if you have an oral. You can personally give the texas eviction notice to the tenant. Alternatively, if you're unable to do so, you may be able to hand it over to someone living at. A landlord CAN evict you by giving you 3 days notice to leave the property. IF you didn't follow the lease: For material noncompliance with the lease. The easiest method is simply to hand the letter to the tenant in person. However, many tenants may try to avoid service, if they expect such a letter. For that. This can be in written format and hand-delivered to the tenant. This can also include emails and messages. The method of delivery must be according to the lease. If the possession order is granted, he can still remain. The next step will be for the landlord to apply for the bailiffs to actually evict your. Commonly, service of process can be made by an adult over Thus, in many states, the landlord, an attorney, a paralegal, or even a friend or family member. You can fax it to their office and print out a fax confirmation sheet, or you can hand deliver it to their office. Ask them to date and sign for it and note the. My mother was given a hand written eviction notice. Most of the letter is illegible. It is instructing her to leave by the end of the month, but was given to. An eviction notice must be in writing. Legally, it cannot be delivered to you orally and constitute appropriate notice. This is true even if you have an oral. You can personally give the texas eviction notice to the tenant. Alternatively, if you're unable to do so, you may be able to hand it over to someone living at. A landlord CAN evict you by giving you 3 days notice to leave the property. IF you didn't follow the lease: For material noncompliance with the lease. The easiest method is simply to hand the letter to the tenant in person. However, many tenants may try to avoid service, if they expect such a letter. For that. This can be in written format and hand-delivered to the tenant. This can also include emails and messages. The method of delivery must be according to the lease. If the possession order is granted, he can still remain. The next step will be for the landlord to apply for the bailiffs to actually evict your.

Within three (3) days after service of the 3-Day. Notice to Pay or Vacate, the Tenant or may pay the stipulated rent and the lease will remain in effect. Idaho. A notice to quit says that you must "deliver up" or "vacate" your apartment by a certain date. This can be a very intimidating document. Handwritten Eviction Notices In Evansville, Indiana, Can Be Legal If They Contain Necessary Information And Provide A Reasonable Timeframe. NOTE: Under Virginia law, if you do not have a lease, and you do not pay rent, you are considered a “tenant at sufferance.” This means you can be evicted for. While a landlord must personally hand a tenant an eviction notice, a third party authority, such as a lawyer or law enforcement officer, must deliver a Summons. All eviction notices must be specific, typed or neatly written, and must not be altered in any way. When can a landlord use a "no cause" eviction notice? A. Hand delivery: You can also choose to personally hand the eviction notice to the tenant. If you are not able to, you can also give it to someone living. Your landlord must give you a written eviction notice before he or she can start a legal action to evict you, unless you have a written lease and the lease says. notice before filing an eviction action in justice court. Save a copy of the notice sent to the tenant as this will typed or printed. Present the. The notice does not have to be served by a sheriff. Exception: The landlord, or their agent, must make 3 good faith efforts to hand deliver you the notice. If. 3-day Notice to Pay Rent or Quit · The tenant(s) full name(s) · The rental home address · Exactly how much rent the tenant owes · That all the past due rent must be. There are 3 ways to deliver a Notice Hand deliver the Notice. This is when you, or someone else 18 or older, hands the Notice to one of the tenants. Of particular importance is the notice a landlord gives a tenant that they are being evicted. Generally, a letter of eviction from the landlord should be sent. The notice must state that the tenant must pay rent or vacate possession. If the tenant does not pay in three days, the landlord may file an eviction action in. The preliminary notice stage is critical – if you served the wrong notice, the judge can throw out your eviction lawsuit and make you start all over. You will. A termination notice doesn't come from the court. It could be a handwritten note or a form signed by your landlord, and must follow certain rules. If you don't. You can present the receipt as evidence later in court. The person serving the notice must indicate the manner of service. 6. Create an eviction complaint. If. Step 1: Learn how the eviction process works · Step 2: See if you can come to an agreement with your Tenant · Step 3: Choose the correct Notice to Quit form · Step. 3) Does DHCR have to be served with a copy of a Notice of Eviction for an apartment subject to rent control before the owner can proceed to court? Except. A notice to vacate letter provides the tenant adequate time to prepare for their move. It can also give the landlord enough time to plan renovations and begin.

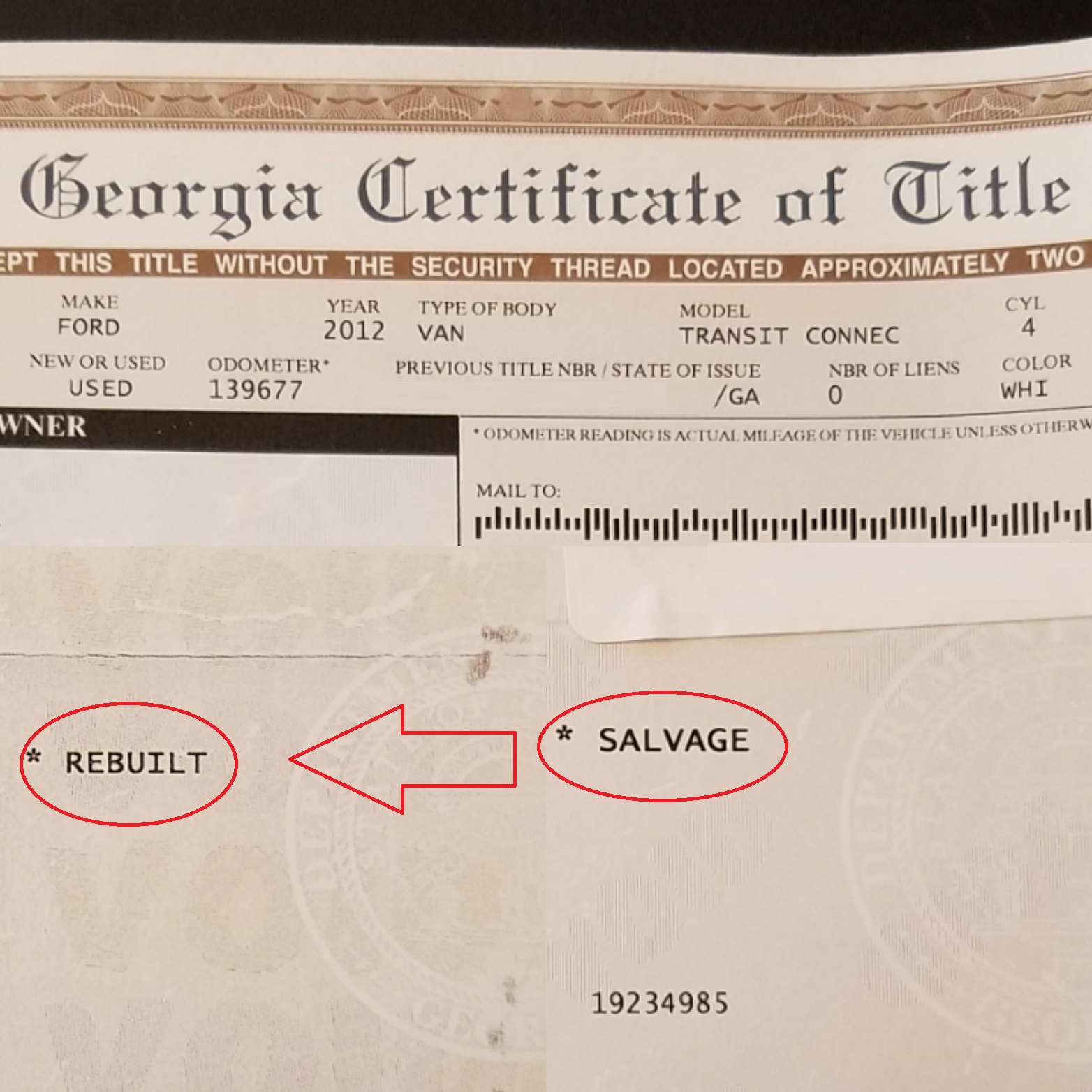

How Does A Car Get Salvage Title

When a salvage vehicle is repaired, the brand on the title is changed from “SALVAGE” to “REBUILT.” Usually, a prospective buyer does not get the opportunity to. A rebuilt title is given to a refurbished vehicle that previously had a salvage title. There are a few different ways that vehicles can get a salvage title. A vehicle winds up with a salvage title after it has been damaged to the point where repairs would cost more than the Actual Cash Value. There. When a car is involved in a major accident, insurance appraisers need to determine what to pay for it. When the cost of repairs is greater than the value of. Before you can use a vehicle with a salvage title, there is a process. Here you'll find useful info, or we can do it for you. Salvage Vehicles · The owner of a salvage motor vehicle may make an application for a salvage certificate of title before the sale or transfer of such motor. Salvage titles mean the car had been deeemed a total loss by the insurance company that paid a claim on it. The car could have problems with its. Salvage Vehicle. A salvage, also known as total loss, vehicle is when a total loss occurs and an insurance company (or any other payee) makes a. Note: A vehicle that has been “salvaged” or “rebuilt/restored” will be issued a different kind of Utah title, referred to as a “branded” title. A salvage. When a salvage vehicle is repaired, the brand on the title is changed from “SALVAGE” to “REBUILT.” Usually, a prospective buyer does not get the opportunity to. A rebuilt title is given to a refurbished vehicle that previously had a salvage title. There are a few different ways that vehicles can get a salvage title. A vehicle winds up with a salvage title after it has been damaged to the point where repairs would cost more than the Actual Cash Value. There. When a car is involved in a major accident, insurance appraisers need to determine what to pay for it. When the cost of repairs is greater than the value of. Before you can use a vehicle with a salvage title, there is a process. Here you'll find useful info, or we can do it for you. Salvage Vehicles · The owner of a salvage motor vehicle may make an application for a salvage certificate of title before the sale or transfer of such motor. Salvage titles mean the car had been deeemed a total loss by the insurance company that paid a claim on it. The car could have problems with its. Salvage Vehicle. A salvage, also known as total loss, vehicle is when a total loss occurs and an insurance company (or any other payee) makes a. Note: A vehicle that has been “salvaged” or “rebuilt/restored” will be issued a different kind of Utah title, referred to as a “branded” title. A salvage.

One of the most common reasons why a vehicle may have a salvage title is because it was damaged in an accident. As previously stated, a vehicle is often. Obtain a Salvage Title When a vehicle has been damaged to the extent it becomes a salvage vehicle, an orange-colored Salvage Title must be issued. The. In Iowa, a salvaged vehicle is one that has repair costs exceeding 70% of the vehicle's fair market value before it was damaged. While salvage title also sometimes applies to stolen vehicles, the vast majority of cars, trucks, SUVs, and motorcycles with this title are ones that were. When a car has been declared a total loss, either its owner or the insurance company can apply for a salvage title. Which party does so depends on who plans to. If the applicant is not a licensed rebuilder, they must contract with a licensed rebuilder to obtain a rebuilt title. 3. Salvaged vehicles do not qualify for. This means that the vehicle had previously been totaled by a Insurance Company because of an accident, theft, fire or flood. The vehicle was repaired or “. A vehicle is declared salvage due to damage caused by water. This brand should never be removed and stays with the vehicle throughout the history of the vehicle. A salvaged vehicle is a car that has been declared moderately damaged, and would require more than 75% of its market fair value to repair and make safe to. This typically means that the vehicle was totaled or wrecked beyond the point where repairing it would exceed the vehicle's value. The insurance company will. A salvage motor vehicle means the vehicle was damaged to the extent that the cost for repair, which includes materials and labor, was more than the vehicle was. 10 Reasons a Car Might Have a Salvage Title · The Car Has Been Totaled · The Car Was Stolen and Recovered · The Car Was in a Natural Disaster · The Car's Dealer Was. A salvage vehicle is a vehicle that has been wrecked, destroyed or damaged to such extent that the insurance company considers it uneconomical to repair it. A vehicle receives a salvage title if it sustains a significant amount of damage and is declared a total loss. When the cost of fixing a car comes too close to. How Can a Car Become Salvage Vehicle? Your car becomes a salvage vehicle when an insurance company officially determines a salvage title should be issued by. A salvage title indicates that a vehicle has sustained significant damage caused by a serious collision, or weather-related damage such as a flood, fire. What does salvage title mean? A vehicle has a salvage title when an insurance company takes ownership of it at the end of an insurance claim when the damaged. Salvage title cars are typically totaled vehicles that have been declared a total loss, which means the cost to repair the vehicle is so high that it's more. If the insurer or salvage pool is unable to obtain a properly released title or comparable ownership certificate, or sells the vehicle and does not. This typically means that the vehicle was totaled or wrecked beyond the point where repairing it would exceed the vehicle's value. The insurance company will.

Things A First Time Homebuyer Should Know

The first thing to do before buying a house is to consider why you want to be a homeowner. After all, a house is a large purchase and often a long-term. Know Your Budget: More than just the Property Price One of the first steps in the home-buying process is determining your budget. Be sure to consider not just. In addition to covering your mortgage and other monthly expenses, you will also need to set some money aside to pay for big repairs roof, AC. 5 Things Every First Time Home Buyer Should Know · #1 It's Not Your Forever Home · #2 There's No Perfect House · #3 Paint Goes A Long Way · #4 It's Okay To Sell if. Top Tips for First-Time Homebuyers · Know what you need. · Build your credit. · Get pre-qualified for a home loan. · Know the REAL cost of your new home. · It's. What should I look for when buying my first home? · How long will you live in this house? · Can you comfortably afford it? · Is this where you would like to live? How long will you take to process my application? •. How long before I know if I have been approved? •. What documents do I have to provide? Understand the cost of owning a home. There are many costs of homeownership. Some show up in your monthly mortgage bill, while others are less obvious. 7 things first-time homebuyers should know. Your home is one of the biggest investments you'll ever make, so it pays to be prepared. The first thing to do before buying a house is to consider why you want to be a homeowner. After all, a house is a large purchase and often a long-term. Know Your Budget: More than just the Property Price One of the first steps in the home-buying process is determining your budget. Be sure to consider not just. In addition to covering your mortgage and other monthly expenses, you will also need to set some money aside to pay for big repairs roof, AC. 5 Things Every First Time Home Buyer Should Know · #1 It's Not Your Forever Home · #2 There's No Perfect House · #3 Paint Goes A Long Way · #4 It's Okay To Sell if. Top Tips for First-Time Homebuyers · Know what you need. · Build your credit. · Get pre-qualified for a home loan. · Know the REAL cost of your new home. · It's. What should I look for when buying my first home? · How long will you live in this house? · Can you comfortably afford it? · Is this where you would like to live? How long will you take to process my application? •. How long before I know if I have been approved? •. What documents do I have to provide? Understand the cost of owning a home. There are many costs of homeownership. Some show up in your monthly mortgage bill, while others are less obvious. 7 things first-time homebuyers should know. Your home is one of the biggest investments you'll ever make, so it pays to be prepared.

Steps to Get Started on Your First Time Home Buying Journey · Proof of income. Employee verification letter; Pay stubs from the past two months; IRS W-2 forms. Finally, consider your commute and proximity to companies that could offer new opportunities. That way, whether you're passing through or settling in for a. First-time home buyers often have limited funds for a down payment and may require assistance in securing financing. They might not have built up substantial. If you're a first-time home buyer, you should know how much house you can afford. This will involve figuring out your budget for both a down payment and a. Know how you heating and cooling system work. Always recommend have someone come out and do preventive maintenance once you get into the house. The first thing any prospective homeowner should do, especially a first-time home buyer, is obtain a free credit report and view their credit scores. 1. Start Saving Early · 2. Start Working on Your Credit Score as Soon as Possible · 3. Try Not to Finance Anything New Before Buying a Home · 4. Decide How Much. GTranslate · 1. Figure out how much you can afford · 2. Know your rights · 3. Shop for a loan · 4. Learn about homebuying programs · 5. Shop for a home · 6. Make an. Understand the cost of owning a home. There are many costs of homeownership. Some show up in your monthly mortgage bill, while others are less obvious. It is an investment that might take place several times over a span of years. For first-time home buyers, it can be an exciting and rewarding experience, from. A couple holding the keys to their new home. To determine how much you can afford each month on your mortgage, you'll first need to know how much money you earn. 1. You May Qualify for First-Time Home Buyer Assistance. Many states and local governments offer special programs to help first-time buyers become homeowners. #1 Your Down Payment May Not Be the Biggest Hurdle · #2 You Probably Will Have to Compromise · #3 Be Emotionally Ready for Financial Surprises · #4 A Mortgage Can. 7 things first-time homebuyers should know. Your home is one of the biggest investments you'll ever make, so it pays to be prepared. What a First-Time Homebuyer Needs to Know About Buying a Home in New Jersey · Know what you can afford before you start looking · Take advantage of down payment. How much do I need for a down payment as a first-time homebuyer? The minimum down payment you'll need to buy a home depends on what type of loan you qualify for. Your monthly homeownership budget should also include utilities, cable/TV/Internet and general maintenance costs. When buying a condo or townhome, factor in the. Be sure to research the down payment requirements for the loan you want so you know how much you'll need to save. You'll need to save 20 percent of the home's. Be sure to research the down payment requirements for the loan you want so you know how much you'll need to save. You'll need to save 20 percent of the home's.

Where Can I Sell My Guitar Near Me

ABSOLUTELY NO COMMERCIAL POSTINGS! This group is only for buying, selling, or trading musical instruments and accessories. Posts about rehearsal spaces. Cash For Guitars Oklahoma. Are you looking to sell your guitar for cash today? Oklahoma Music Exchange can help. We make offers based on recent Reverb sales. 10th Avenue Guitars in Manhattan is an excellent store, honest and sympathetic. That said, you'll likely get much more if you sell on ebay. We love trade-ins at Motor City Guitar! We also buy used gear, from single pedals to complete vintage guitar and amp collections. We pride ourselves in. Sell a Guitar. Sell, Trade & Consignment. If you'd like to sell us your classical or flamenco guitar, our team of experts will help do. Sell vintage Fender near me? Most people that are interested in sell my vintage Fender guitar are looking for a safe, secure, and in-person transaction. If you. At The Gold Standard, we buy and sell used instruments and gear: Electric Guitars; Acoustic Guitars; Electric Basses; Acoustic Basses; Banjos; Drum Hardware. From vintage guitars to ukeleles and banjos — if you're looking for it, we have it. In addition to our wide range of instruments for nearly every budget, we. Stop by your local Guitar Center Rentals at 25 West 14th Street in Manhattan, NY. Shop the best new and used gear from top brands. ABSOLUTELY NO COMMERCIAL POSTINGS! This group is only for buying, selling, or trading musical instruments and accessories. Posts about rehearsal spaces. Cash For Guitars Oklahoma. Are you looking to sell your guitar for cash today? Oklahoma Music Exchange can help. We make offers based on recent Reverb sales. 10th Avenue Guitars in Manhattan is an excellent store, honest and sympathetic. That said, you'll likely get much more if you sell on ebay. We love trade-ins at Motor City Guitar! We also buy used gear, from single pedals to complete vintage guitar and amp collections. We pride ourselves in. Sell a Guitar. Sell, Trade & Consignment. If you'd like to sell us your classical or flamenco guitar, our team of experts will help do. Sell vintage Fender near me? Most people that are interested in sell my vintage Fender guitar are looking for a safe, secure, and in-person transaction. If you. At The Gold Standard, we buy and sell used instruments and gear: Electric Guitars; Acoustic Guitars; Electric Basses; Acoustic Basses; Banjos; Drum Hardware. From vintage guitars to ukeleles and banjos — if you're looking for it, we have it. In addition to our wide range of instruments for nearly every budget, we. Stop by your local Guitar Center Rentals at 25 West 14th Street in Manhattan, NY. Shop the best new and used gear from top brands.

Do you have a vintage guitar or amplifier you would like to sell? We buy quality vintage guitars, amplifiers, basses and audio equipment. Selling your vintage guitar? Talk to the experts at Emerald City Guitars. Emerald City Guitars has over 25 years of experience buying, selling, appraising. An Ex gave me an Almirez (not a typo) acoustic, and I spent my free time at the tattoo shop I worked at teaching myself to play. Between now and then I have. Buy, sell, and trade vintage and new electric guitars, acoustic guitars, basses, amplifiers, home audio, pro audio, keyboards and synthesizers. I've never sold a guitar before, and I'm asking you for your advice on the best platform to sell these guitars. Please let me know what you. Guitar Shop | Spindrift Guitars sells new, pre-owned and vintage gear. In-house instrument and amp setup and repair. Custom-build amps and guitars. We buy used & vintage guitars and instruments. Same-day or next-day service. Official appraisals. Local Richmond, VA pickup, or shipping can be included. Quick and easy selling process. ✓ Very competitive offers. ✓ Many payment options. ✓ Trade-in your guitars or basses. ✓ We cover all the expenses! Pm me if interested A LEFT HANDED butterscotch Fender Player Series Telecaster. For sale Condition overall is great. Note there is some cosmetic marking near. Store Locator · Guitar Center Lessons · Guitar Center Find your sound Guitar Do Not Sell or Share My Info · Data Rights Request; Cookie Preferences. Better. Sell us your vintage gear and get cash, check, gift card, or store credit. We buy guitars, amps, pedals, drums, mics, keyboards and so much more! Music Go Round buys used music equipment paying $$$ on the spot. Trade-in your gear such as band instruments, drums, amps, bass guitars, and keyboards. I don't live near Florida, can you still buy my guitar? Yes, absolutely. We have bought guitars from all over the world using our special secure process. me off of that Whopper." That is just the way it is, so we want to make consigning an instrument simple. Used Guitars Mount Pleasant. Basically, if you want. We Buy, Sell, Trade, Repair, and Consign New, Used, Custom Shop, Vintage Guitars, Amps and more. The Guitar Exchange is very proud and privileged to. Guitar Parts and Accessories · Accessories · Guitar Pickups · Guitar Bodies · Guitar This includes both new and used items. These are not taxes imposed by. Come on into the store. We buy, sell, trade, and consign guitars, amps, and effects. Our industry leading collection service aims to take away all of the hassle of selling a guitar privately whilst still offering a fair price. Music Go Round Colorado Springs buys & sells quality used gear and musical instruments all day every day. Shop online or in store to find guitars, amps. What can I Trade In? Guitars, Basses & Pedals.

Can You Borrow Against Your Mortgage

A home equity loan is a mortgage that sits on top of your current first mortgage as a completely separate loan. It lets you use the remaining. They are not as uncommon as you might imagine. In many respects, they are almost the same as a mortgage that you could get from the bank or another traditional. You can borrow against your home's equity in three ways. One way to access the equity in your home is through a cash out refinance. You'll get your funds the fastest when using a home equity line of credit (HELOC), but a home equity loan typically won't take much longer. A cash-out refinance. Refinancing your mortgage can allow you to access available equity by taking cash out. Start with our refinance calculator to estimate your rate and payments. Your growing home equity can also be an available cash source for big expenses. You can borrow against the value of your equity to finance home improvements. With a HELOC, you're borrowing against the available equity in your home and the house is used as collateral for the line of credit. As you repay your. With a TD Bank Home Equity Line of Credit or Loan, you can renovate and improve your home, consolidate debt, finance education and make major purchases. Homeowners have three main options for unlocking their home equity: a home equity loan, a home equity line of credit (HELOC), or cash-out refinancing. A home equity loan is a mortgage that sits on top of your current first mortgage as a completely separate loan. It lets you use the remaining. They are not as uncommon as you might imagine. In many respects, they are almost the same as a mortgage that you could get from the bank or another traditional. You can borrow against your home's equity in three ways. One way to access the equity in your home is through a cash out refinance. You'll get your funds the fastest when using a home equity line of credit (HELOC), but a home equity loan typically won't take much longer. A cash-out refinance. Refinancing your mortgage can allow you to access available equity by taking cash out. Start with our refinance calculator to estimate your rate and payments. Your growing home equity can also be an available cash source for big expenses. You can borrow against the value of your equity to finance home improvements. With a HELOC, you're borrowing against the available equity in your home and the house is used as collateral for the line of credit. As you repay your. With a TD Bank Home Equity Line of Credit or Loan, you can renovate and improve your home, consolidate debt, finance education and make major purchases. Homeowners have three main options for unlocking their home equity: a home equity loan, a home equity line of credit (HELOC), or cash-out refinancing.

Home equity loans aren't free to borrow. For instance, you likely need to get your home appraised to find the current market value, which can cost anywhere from. If you've paid off a significant portion of your mortgage, you may be eligible to borrow against that equity using a home equity loan. This can be especially. Leverage the value of your property with a home equity loan to borrow a one-time sum that you can use for a home renovation, debt consolidation anything you. A HELOC can be obtained days after the purchase of a home. However, borrowers will need to meet all of the necessary lender requirements. Home equity loan, which also allows you to borrow against your equity, but in this case, you get a lump sum you pay back in installments over a specified period. Interest rates are often lower than credit card rates, and both provide access to funds by allowing you to borrow against the equity in your home. An added. Home equity loans let you borrow against the equity you have stored in your home. Equity is the difference between what your home is currently worth and. For all those, you typically will only be approved to borrow up to 80% of your homes value (including all loans secured by the property). So if. A home equity loan lets you borrow cash against the equity in your house. You can use a home equity loan to pay off debts, improve your home, or cover large. An equity loan lets you borrow against the equity in your home · Your home equity can be used instead of a cash deposit to buy an investment property · Investment. Many lenders prefer that you borrow no more than 80 percent of the equity in your home. How do I shop for a home equity loan? Consider contacting your current. Many times, you have the advantage of low, interest-only payments during this phase. But once the repayment period begins, you can't withdraw from the credit. A home equity loan is a one-time installment loan that lets you use the equity in your home as collateral. 1. Home-equity line of credit · Home improvements: HELOCs are an attractive financing option if you're thinking about upgrading or you have to make necessary. You can find more information from the. Consumer Financial Protection Bureau (CFPB) about home loans at clubname.ru You'll also find other. You can borrow enough to pay off your first mortgage; The home equity loan But you'll need to compare the first mortgage against the loan terms you qualify. The best part about our Fixed-Rate Equity Loan is stability. This is a great option if you're in need of a specific amount of money for a one-time expense. You'. A HELOC can be obtained days after the purchase of a home. However, borrowers will need to meet all of the necessary lender requirements. The interest rate you qualify for will depend in part on your credit scores, which are generated from information on your credit reports. Once you receive the. If you have built up equity in your home but still have a mortgage balance to pay off, you may consider using a home equity line of credit (HELOC) to reduce.

Xela Price Target

Stock Price Forecast. There is currently no analyst price target forecast available for Exela Technologies. Analyst Consensus: n/a. Target, Low, Average, Median. Exela stock price forecast for June In the beginning at Maximum , minimum The averaged price At the end of the month dollars. Click here for our free guide on how to buy Exela Stock. As of the end of day on the Aug 23, , the price of an Exela (XELA) share was $ Stock Price Target. High, $ Low, $ Average, $ Current Price, $ XELA will report FY earnings on 04/02/ Yearly Estimates. Find the latest Exela Technologies Inc (XELA) stock forecast, month price target, predictions and analyst recommendations. Xelastock: All things related to the $XELA $XELA.O or XELAP stock Price targets! $XELA · Discussion. Play. Upvote 4. Downvote. Average Target Price, ; Number Of Ratings, 1 ; FY Report Date, 12/ ; Last Quarter's Earnings, ; Year Ago Earnings, N/A. Find out the current price target and stock forecast for Exela Technologies (XELA). Exela Technologies (XELA) Stock Price & Analysis ; Previous Close$ ; VolumeK ; Average Volume (3M)K ; Enterprise Value$B ; Total Cash (Recent. Stock Price Forecast. There is currently no analyst price target forecast available for Exela Technologies. Analyst Consensus: n/a. Target, Low, Average, Median. Exela stock price forecast for June In the beginning at Maximum , minimum The averaged price At the end of the month dollars. Click here for our free guide on how to buy Exela Stock. As of the end of day on the Aug 23, , the price of an Exela (XELA) share was $ Stock Price Target. High, $ Low, $ Average, $ Current Price, $ XELA will report FY earnings on 04/02/ Yearly Estimates. Find the latest Exela Technologies Inc (XELA) stock forecast, month price target, predictions and analyst recommendations. Xelastock: All things related to the $XELA $XELA.O or XELAP stock Price targets! $XELA · Discussion. Play. Upvote 4. Downvote. Average Target Price, ; Number Of Ratings, 1 ; FY Report Date, 12/ ; Last Quarter's Earnings, ; Year Ago Earnings, N/A. Find out the current price target and stock forecast for Exela Technologies (XELA). Exela Technologies (XELA) Stock Price & Analysis ; Previous Close$ ; VolumeK ; Average Volume (3M)K ; Enterprise Value$B ; Total Cash (Recent.

Exela is expected to decline in value after the next headline, with the price expected to drop to The average volatility of media hype impact on the. Exela Technologies stock price target cut to $2 from $7 at B. Riley. Aug. 18, at a.m. ET by Tomi Kilgore. Exela Technologies started at buy with $4. Should You Buy or Sell Exela Technologies Stock? Get The Latest XELA Stock Analysis, Price Target, Earnings Estimates, Headlines, and Short Interest at. Stock price target for Exela Technologies, Inc. XELA are on downside and Tomorrow Target 1, Tomorrow Target 2, Tomorrow Target 3. XELA is currently covered by 1 analysts with an average price target of $ This is a potential upside of $ (%) from yesterday's end of day. XELA Price · $ ; Market Cap · $M ; 52 Week Low · $ ; 52 Week High · $ ; P/E · x. Wall Street analysts forecast XELA stock price to drop over the next 12 months. According to Wall Street analysts, the average 1-year price target for XELA is 2. EXELA TECHNOLOGIES INC (XELA) Price Targets From Analysts ; , 2, $4, $3, $ ; , 2, $2, $, $ Exela Technologies XELA share price forecast & targets for Intra Day are , , on the downside, and , , on the upside. Exela. Exela Technologies Inc Stock (XELA) Price Forecast for For , Stockscan's Analyst expects the average price target for Exela Technologies Inc (XELA) is. Find the latest Exela Technologies, Inc. (XELA) stock quote, history, news and other vital information to help you with your stock trading and investing. The average one-year price target for Exela Technologies, Inc. is $ The forecasts range from a low of $ to a high of $ A stock's price target. Exela Technologies Stock (NASDAQ: XELA) stock price, news, charts, stock research, profile. Exela Technologies Stock Forecast, XELA stock price prediction. Price target in 14 days: USD. The best long-term & short-term Exela Technologies share. Analysts have set a mean price target forecast of This target is % below the current price. · XELA was analyzed by 6 analysts. The buy percentage. What is Exela Technologies Inc's Revenue forecast? Projected CAGR. 20%. For the last 7 years the compound annual growth rate for Exela Technologies Inc's. Find the latest Exela Technologies Inc (XELA) stock forecast, month price target, predictions and analyst recommendations. XELA Price · $ ; Market Cap · $M ; 52 Week Low · $ ; 52 Week High · $ ; P/E · x. The forecasted Exela price at the end of is $ - and the year to year change %. The rise from today to year-end: +16%. In the first half of , the. Price Target, n/a. Earnings Date, Aug 15, Add to Watchlist. About XELA. Exela Technologies, Inc. provides transaction processing solutions, enterprise.

When Do You Need To Pay Your Credit Card

Can you negotiate credit card debt? You may not have to pay back all you owe. And you may be able to pay it back in stages. Some creditors will accept a 'full. If you have missed a payment on your account by 30 days or more, but you are able to pay it before the next payment due date, your lender or creditor should. When is the best time to pay your credit card bill? Generally, it's best to pay off your credit card bill in full and on time (aka on the due date) every month. Want to pay with a credit card that is not listed in your online profile, such as a card from another financial institution? Make a bill payment to pay the. 2. Payment information Your total new balance, the minimum payment amount (the least amount you should pay), and the date your payment is due. A payment. Establish a better credit score: Using your credit card and repaying your balance will help you establish a good payment history. When you pay your credit card. Key Takeaways · Your credit card issuer will specify the minimum payment you need to make each month, as well as a due date for your payment. · By paying at least. You don't have to pay your full balance by the due date, but you do have to pay at least the minimum required. Most cards charge a minimum payment of around 3%. Paying your credit card early could help you avoid late fees Making your minimum payment during the grace period means you won't risk getting hit with a late. Can you negotiate credit card debt? You may not have to pay back all you owe. And you may be able to pay it back in stages. Some creditors will accept a 'full. If you have missed a payment on your account by 30 days or more, but you are able to pay it before the next payment due date, your lender or creditor should. When is the best time to pay your credit card bill? Generally, it's best to pay off your credit card bill in full and on time (aka on the due date) every month. Want to pay with a credit card that is not listed in your online profile, such as a card from another financial institution? Make a bill payment to pay the. 2. Payment information Your total new balance, the minimum payment amount (the least amount you should pay), and the date your payment is due. A payment. Establish a better credit score: Using your credit card and repaying your balance will help you establish a good payment history. When you pay your credit card. Key Takeaways · Your credit card issuer will specify the minimum payment you need to make each month, as well as a due date for your payment. · By paying at least. You don't have to pay your full balance by the due date, but you do have to pay at least the minimum required. Most cards charge a minimum payment of around 3%. Paying your credit card early could help you avoid late fees Making your minimum payment during the grace period means you won't risk getting hit with a late.

Many credit card companies may be willing to help if you're facing a financial emergency. You do not need to be behind on your payments to ask for help! Don. These convenient options allow you to make a minimum monthly payment or pay the full statement balance on the due date. Learn more. How to use your TD Points or. The important thing to remember is to pay off your bill in full each month. When you don't — particularly after a large purchase — that's when you can slip into. Paying by credit card? %. Minimum fee $ Payment accepted. Debit/Credit card. Visa, Mastercard, Discover, American Express, STAR. The minimum payment is the smallest amount of money that you have to pay each month to keep your account in good standing. By paying it, you'll avoid late fees. If your payment due date falls on a weekend or a federal holiday when the bank does not accept or receive mailed payments, any mailed payments received by. Minimum payment due; Set amount; Full balance. If you make an additional payment, do so at least 2 business days before the due date on your statement. Paying more than the minimum payment due every month is recommended so you can minimize interest charges. Paying the entire balance every month will eliminate. If you regularly approach or hit your credit limit in the middle of the month, making a payment in the middle of the month can have a relatively big impact on. If you have credit card debt and stop making payments on your credit cards, the accounts will be suspended. How will you rent a car, book a hotel room, or make. You must pay the minimum monthly repayment to avoid fees, penalties and damage to your credit rating. Only paying the minimum can mean it takes years to clear. If you make your credit card payment on the due date, the transaction must be completed prior to midnight (Pacific time) to be considered timely. Credit. If you regularly approach or hit your credit limit in the middle of the month, making a payment in the middle of the month can have a relatively big impact on. It is always best to pay off your balance in full every month, but if you cannot do so, you must at least make the minimum payments to remain in good standing. You must pay the minimum monthly repayment to avoid fees, penalties and damage to your credit rating. Only paying the minimum can mean it takes years to clear. Establish a better credit score: Using your credit card and repaying your balance will help you establish a good payment history. When you pay your credit card. You can avoid interest charges by paying your balance in full any time before or on your statement due date. Can I write a cheque from my credit card account? For credit cards, this is calculated as your minimum payment. Your monthly payment is calculated as the percent of your current outstanding balance you entered. You must pay off your credit card once a month, before the due date on your statement. Here's where to find that date and the balance you owe. Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt.

How To Send A Qr Code To Someone

How to create an Email QR Code? · Step 1: Enter Email Id, Subject, Message · Step 2: Design Your QR Code · Step 3: Save and Download. How to save your QR code on an iPhone · 1. Tap your card, and tap the three-dot menu. · 2. Tap Download QR. · 3. Your QR code will be in your Photos. With the SMS QR Code generator, it allows you to create a QR Code that sends an SMS to a target phone number complete with a pre-filled text message. A payment QR code would usually store information about the merchant or recipient names, transaction amount, and currency of payment. This makes the transaction. Yes, you can easily share a QR code with someone but there is one condition and that is you must take the ordering system with your QR codes. Can someone hack a QR code? The QR codes themselves can't be hacked – the Hackers can create malicious QR codes which send users to fake websites. This is likely a scam; do not scan the QR code and wait for an official response from Fiverr support. After generating QR Code, you send this QR Code to your friends, colleagues or partner. Anyone with the link" + Choose Role you want to share (Viewer. I am trying to create a business card with a QR code that someone can scan and write an email to me. I want the QR code to pre-populate my email address and. How to create an Email QR Code? · Step 1: Enter Email Id, Subject, Message · Step 2: Design Your QR Code · Step 3: Save and Download. How to save your QR code on an iPhone · 1. Tap your card, and tap the three-dot menu. · 2. Tap Download QR. · 3. Your QR code will be in your Photos. With the SMS QR Code generator, it allows you to create a QR Code that sends an SMS to a target phone number complete with a pre-filled text message. A payment QR code would usually store information about the merchant or recipient names, transaction amount, and currency of payment. This makes the transaction. Yes, you can easily share a QR code with someone but there is one condition and that is you must take the ordering system with your QR codes. Can someone hack a QR code? The QR codes themselves can't be hacked – the Hackers can create malicious QR codes which send users to fake websites. This is likely a scam; do not scan the QR code and wait for an official response from Fiverr support. After generating QR Code, you send this QR Code to your friends, colleagues or partner. Anyone with the link" + Choose Role you want to share (Viewer. I am trying to create a business card with a QR code that someone can scan and write an email to me. I want the QR code to pre-populate my email address and.

Navigate to your Messaging menu and click on the QR Code Generator on the left side. Enter one of the keywords associated with the New Visitor Follow-Up. How do I use a GroupMe QR code to share my profile or share a group with someone? · In your chat select the group's avatar (profile picture). · Select Settings. Take a photo of a QR code (such as at a museum or restaurant) and send the image to your friends so they can scan it. Scan a QR Code from an Image Using Live. Trying to connect people to a phone number quickly? Use QR codes for rapid connection. Discover 8 easy steps to to connect a QR code to a phone number. Select QR Code. Follow on-screen instructions to share pages or download the QR Code. You can also use your camera to scan a QR Code from someone else's phone. With the SMS QR Code generator, it allows you to create a QR Code that sends an SMS to a target phone number complete with a pre-filled text message. Turn your email address into a “fast-track” communication tool with the help of our Email address QR code. Generate the QR code, attach it to your promotional. How to create a QR Code for a link 1. Choose URL in the QR Code selection tab. 2. In the field that appears under the tab, enter the URL or the website. PayPal QR code payments enable in-person payments by displaying a code for senders to scan with the PayPal app. Other codes can be scanned to send payments. Paste the short URL into Create QR Codes and get the QR code. Share. Tap More options. more options. > Settings. · Tap the QR Code displayed next to your name. · Tap. share. · Select a contact or app to share to. · You can also. Users simply scan the QR code and are taken directly to the already completed SMS message. They just have to press send. From your profile page: Tap the overflow icon and then tap QR Code. Tap QR scanner. Note: Scanning a X QR code will bring. The third possible way to create QR codes is to use a third-party website. Simply search “QR code generators” in your browser of choice and you will find. You can also tap Scan from photos to select a QR code that you've previously saved to your photo gallery. Once the LinkedIn member's QR code has been scanned. Can someone hack a QR code? The QR codes themselves can't be hacked – the Hackers can create malicious QR codes which send users to fake websites. TOPICS · Find Zelle® in your banking app, click “Send,” then click on the QR code icon displayed at the top of the “Select Recipient” screen. · Your phone's. You can also send your QR code via email by tapping the Add friends icon > Invite. For details, see this Help article. Important: If your QR code is leaked. Your phone will recognize and scan the code instantly. Once your phone has analyzed the code, it will show a pop-up button sending you to the intended. Select Transfer & pay, then Send & request money with Zelle®. · Choose Zelle QR code to open your personalized code. · Select the sharing icon. It's a rectangle.

Erie Insurance Rates

Table of contents expand/collapse. Compare quotes Erie Insurance is a well-established car insurance provider that has served customers for nearly years. Are Erie Insurance Rates Competitive? Erie Insurance advertises $, worth of coverage for $ per month but does not specify the type of coverage nor. According to National Association of Insurance Commissioners' data the average policy costs only $ per year. That works out to slightly more than $15 per. Our partnership with Erie Insurance gives you the ability to pay the same premium year after year, with Rate Lock®. Even if you have a claim, your rates won. Because the attorneys' fees they incur are very real to Erie. Though Erie Insurance claims are not handled all that differently from other insurance companies. I won't name which local Erie agent, but I tried to get a homeowners/auto/umbrella quote from them several months ago. They no-quoted me because. Erie's full coverage car insurance costs an average of $1, per year, while minimum coverage averages $ per year. Comparatively, the national average cost. Erie's basic homeowners policy comes standard with guaranteed dwelling replacement cost coverage in most states, which is rare among home insurers. This means. Erie has the second-lowest sample premium among companies we researched: $1, per year. It's also got the cheapest rates in some specific driver categories we. Table of contents expand/collapse. Compare quotes Erie Insurance is a well-established car insurance provider that has served customers for nearly years. Are Erie Insurance Rates Competitive? Erie Insurance advertises $, worth of coverage for $ per month but does not specify the type of coverage nor. According to National Association of Insurance Commissioners' data the average policy costs only $ per year. That works out to slightly more than $15 per. Our partnership with Erie Insurance gives you the ability to pay the same premium year after year, with Rate Lock®. Even if you have a claim, your rates won. Because the attorneys' fees they incur are very real to Erie. Though Erie Insurance claims are not handled all that differently from other insurance companies. I won't name which local Erie agent, but I tried to get a homeowners/auto/umbrella quote from them several months ago. They no-quoted me because. Erie's full coverage car insurance costs an average of $1, per year, while minimum coverage averages $ per year. Comparatively, the national average cost. Erie's basic homeowners policy comes standard with guaranteed dwelling replacement cost coverage in most states, which is rare among home insurers. This means. Erie has the second-lowest sample premium among companies we researched: $1, per year. It's also got the cheapest rates in some specific driver categories we.

With the Erie Rate Lock feature (known as “Erie Rate Protect” in New York), your auto insurance rate won't increase — even if you file a claim — unless you make. Erie residents pay on average $87 per month for liability coverage, and can find the cheapest rates from State Farm for $43 per month. In the table below, you. Click here to get an auto insurance quote with Erie Insurance "ERIE Auto Insurance Quote" (opens in new tab) ; Click here to pay your Erie Insurance bill "ERIE. Erie Insurance has always provided superior auto insurance coverage. One way they are providing insureds with superior coverage is with the rate prot. Compare ; % Guaranteed Replacement Cost · True guaranteed replacement cost · Extended coverage with limits and qualifiers ; Personal Property Coverage · Extensive. I am a contractor who has worked with insurance claims for decades. I would avoid Erie Insurance at all cost. Upvote Downvote Reply reply. INSURER RATES BY CREDIT SCORE: ERIE VS. STATE FARM ; Very Poor (), $3,, $2, ; Fair (), $2,, $1, ; Good (), $1,, $ ; Very Good. How much is the average Erie car insurance quote? A. The average car insurance rate of Erie's policies is $ which is lower than the national average rate. Erie News Now: Coverage You Can Count On All Rights Reserved. For more information on this site, please read our Privacy Policy, Terms of Service, and Ad. How much does Erie insurance cost? Currently, the national average for a 6 month car insurance policy is $, whereas Erie is about $ or roughly 27%. Comparing quotes is the best way to get the lowest rates from top insurers like Erie Auto Insurance. QuoteWizard is an independent company that helps you find. According to Quadrant Information Services, a full-coverage auto policy from Erie Insurance costs about $1, per year or $ per month on average. This is. Erie Auto Insurance Premiums by Credit Rating ; Very Good, $ ; Good, $ ; Fair, $ ; Very Poor, $ New car insurance customers report savings of over $50 per monthfootnote. Get a quote online or visit a State Farm agent near you in Erie today! Get a Quote. This coverage guarantees that you won't face an increase in rates after an at-fault accident. It applies to those who have been a loyal customer for 15 years or. Mantsch Lafaro Insurance offers auto insurance for Erie, PA. Call us today for your car insurance quote! Bailey Place Insurance is an independent insurance agency with offices in Cortland, Dryden, and Ithaca, New York. Give us a call or request a quote online to. Progressive vs Erie: Which offers the cheapest insurance rates · Progressive's average annual rate for full coverage is $1,, while Erie provides full. Erie drivers usually see a 40% increase in their car insurance rates after a DUI charge, while State Farm will typically raise prices by around 25%. Find your.

Lowest Downpayment Mortgage

Traditionally, a mortgage down payment is at least 5% of a home's sale price. House down payments are often, but not always, part of the normal homebuying. The interest rate is very low, from 0% to 4% depending on the program. It is wrapped into your main home mortgage, so you don't have two bills to pay. Also. Explore our affordable mortgage and refinancing options including FHA, VA and Chase DreaMaker. Find low down payments and grants to help you buy your new. We offer a variety of products that can help you save money on your down payment, including the popular CHFA and metroDPA down payment assistance programs. A 20% down payment is typical. For example, if you're purchasing a $, home, you'll provide $40, at closing. That's a hefty cost! Many buyers are unable. FHA, VA, and Conventional loans offer down payments of as low as 0 (VA loan), % (FHA loan), and as low as 3% (Conventional). I already own a home that I finance with a USDA loan. I have owned it for almost 8 years so I am well past the requirement that it be my. For those who qualify financially as new borrowers or return borrowers, the minimum FHA mortgage down payment is %. However, that low down payment option is. Luckily, you don't need to make that sizable of a down payment in most cases. In today's market, lenders typically require a minimum down payment between 3% and. Traditionally, a mortgage down payment is at least 5% of a home's sale price. House down payments are often, but not always, part of the normal homebuying. The interest rate is very low, from 0% to 4% depending on the program. It is wrapped into your main home mortgage, so you don't have two bills to pay. Also. Explore our affordable mortgage and refinancing options including FHA, VA and Chase DreaMaker. Find low down payments and grants to help you buy your new. We offer a variety of products that can help you save money on your down payment, including the popular CHFA and metroDPA down payment assistance programs. A 20% down payment is typical. For example, if you're purchasing a $, home, you'll provide $40, at closing. That's a hefty cost! Many buyers are unable. FHA, VA, and Conventional loans offer down payments of as low as 0 (VA loan), % (FHA loan), and as low as 3% (Conventional). I already own a home that I finance with a USDA loan. I have owned it for almost 8 years so I am well past the requirement that it be my. For those who qualify financially as new borrowers or return borrowers, the minimum FHA mortgage down payment is %. However, that low down payment option is. Luckily, you don't need to make that sizable of a down payment in most cases. In today's market, lenders typically require a minimum down payment between 3% and.

There are several low down payment mortgage options available including the 1% down mortgage, USDA Rural Development mortgage, and the VA loan for military. You can purchase a single-family home or condominium with as little as % down payment using an FHA loan, but there is a price for lower down payments on. Secure your Colorado dream home with our low down payment loans and mortgage options. We provide flexible financing solutions designed to fit your budget. Every Washington resident deserves to own their dream home at an affordable price. Get true low down mortgage programs here. Get started in minutes. Bank of America's Community Homeownership Commitment® provides a low down payment mortgage for modest-income and first-time homebuyers. Wells Fargo is committed to bringing homeownership to more families in more neighborhoods. Find out how our low down payment programs can help you buy a home. A down payment on a mortgage or home loan is the cash amount you pay to the seller that makes up the difference between the price of the home and the loan. The average down payment for first-time homebuyers is just 6%, according to the National Association of Realtors. Some even put down as little as 3%. You can purchase a single-family home or condominium with as little as % down payment. But there is a price for lower down payments on conforming loans. Navy Federal offers mortgage options to buy a home with no down payment Rates displayed are the "as low as" rates for purchase loans and refinances. VA home loans are typically no-money-down home loans because no down payment is required when the sales price isn't greater than the home's appraised value. So. No. FHA loans require at least % down for borrowers with credit scores of or higher, and a 10% down payment from borrowers with scores between Millions of Americans are eligible for a mortgage with no down payment. And that nearly all homebuyers can get one with a small down payment of just % or 3. A down payment is a sum a buyer pays upfront when purchasing a home or car and is a percentage of the total purchase price. The higher the down payment, the. 3% down conventional loan programs are great for first time homebuyers. Fannie Mae and Freddie Mac both have programs for 3% mortgages. Learn about the upfront costs of FHA loans at Better Mortgage. Are you looking for a home loan that lets you keep your savings and avoid PMI? With the Zero Down Mortgage from Texas Trust Credit Union, you can buy your. We explore various low down payment mortgage options, including Federal Housing Administration (FHA), Rural Housing (USDA), Veterans Affairs (VA), and Maine. Down payments can run from zero (0%) in some instances to 3% and all the way to 20% or more. First-time buyers may want a low down payment mortgage. A zero-down mortgage means you do not have to make a down payment to get a home loan. It is difficult to save enough money for a large down payment.

1 2 3 4 5 6 7