clubname.ru Market

Market

Best Money Accounts

Quontic Bank: Best money market account for savers who prefer digital banking. Quontic Bank is a New York City-based digital bank that also serves as a. If you are looking to save but also want the ability to write checks and access funds with a debit card, our Flex Money Market account is perfect for you. 1. Today's top money market APYs from nationwide banks are % from Brilliant Bank, % from MYSB Direct, and % from Republic Bank of Chicago. A simple and affordable way to save for the future, and to earn some interest while doing it! The Statement Savings Account is great for first-time savers or. Banks and credit unions offer high-yield savings accounts, money market accounts, certificates of deposit, mutual funds and more. To ensure you have the best possible experience, we use cookies and similar technologies on our site. Some are necessary for helping our site run smoothly and. Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today. As such, an MMA may be a good idea to save for a specific purchase, such as a vacation or a down payment for a car. This account can also be used as a rainy day. What is a money market account? Found at banks and credit unions, a money market account is a type of deposit account with features of both checking accounts. Quontic Bank: Best money market account for savers who prefer digital banking. Quontic Bank is a New York City-based digital bank that also serves as a. If you are looking to save but also want the ability to write checks and access funds with a debit card, our Flex Money Market account is perfect for you. 1. Today's top money market APYs from nationwide banks are % from Brilliant Bank, % from MYSB Direct, and % from Republic Bank of Chicago. A simple and affordable way to save for the future, and to earn some interest while doing it! The Statement Savings Account is great for first-time savers or. Banks and credit unions offer high-yield savings accounts, money market accounts, certificates of deposit, mutual funds and more. To ensure you have the best possible experience, we use cookies and similar technologies on our site. Some are necessary for helping our site run smoothly and. Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today. As such, an MMA may be a good idea to save for a specific purchase, such as a vacation or a down payment for a car. This account can also be used as a rainy day. What is a money market account? Found at banks and credit unions, a money market account is a type of deposit account with features of both checking accounts.

We're breaking down some of the best high-yield savings accounts so you can find the perfect place to grow your cash. Discover's Money Market account gets you high interest rates, no fees and lets you access your cash via ATM, debit card and checks. Open a money market. Vanguard Cash Plus Account · $0 initial minimum investment. · Connect the Cash Plus Account to payment apps like Pay Pal or Venmo and access your money penalty. This account offered by Bank of America for Wealth Management clients offers tiered interest rates, discounts and waivers on everyday banking services. Ally Bank Money Market Account · % APY · Competitive APY ; Northern Bank Direct Money Market Account · % APY · Free checks, ATM card and online bill pay. Experience the best of both worlds with our Popular Saver Money Market account — enjoy a fixed rate and flexibility. When you open a new Popular Saver Money. Sallie Mae Bank. The Sallie Mae Money Market account offers a top-tier APY on any account balance. READ REVIEW. EQ Bank has remained at the top of our list for a while with its 4% rate. The only ones to supplant EQ Bank is none other than EQ Bank. It's simple. You choose. It's also a great account for your 'rainy day fund'. You know, for when you need money for things you didn't plan for, like car repairs or when the washing. Best Savings Accounts – August · Top Savings Account Interest Rates · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One - 's Best Money Market Accounts - Editors' Picks ; With Low Fees, Vio Bank Cornerstone Money Market Savings Account, % ; For $,+ Balances, TotalBank. Shop around for competitive money market accounts from different banks and credit unions. Choose one that works best for your needs. Key Select Money Market Savings · Earn % interest rate (% blended APY) for 6 months. See how · Rate available on balances of $25, to $1,, with. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area Top Deposit Links. Discover's Money Market Account has no fees and an attractive pair of yields % APY for balances under $, and % APY for balances of $, and. If you want to earn the maximum amount on your savings, you might consider opening an account at Simplii Financial. This online bank is currently promoting and. Money Market Select. Named Best Money Market Account for small balances by Investopedia. Interest Rate Up to $2, % APY1. Opening Deposit. $1. Open. US News carefully evaluated over 80 banks and credit unions. Find the right bank for your needs, from large national institutions to online-only savings banks. A high-yield savings account is a deposit account where your money grows quickly (at least compared to traditional savings accounts) while remaining fairly.

Loan On 15000

Calculate new or used car loan payments with this free auto loan calculator. You can also estimate savings with our free auto loan refinance calculator. Our handy Personal Loan Calculator can help you calculate estimated monthly payments. The Personal Loan Calculator can give concise visuals to help determine what monthly payments and total costs will look like over the life of a personal loan. Your monthly payment for a personal loan will depend on the amount, term, and interest rate of the loan (which is highly dependent on your credit score). (The loan calculator can be used to calculate student loan payments, auto loans or to calculate your mortgage payments.) Jump to Calculator. Calculating. How much are the monthly payments for a $15, car loan? ; %, 1,, ; %, 1,, ; %, 1,, ; %, 1,, Need a $ loan fast? Acorn Finance is % free to borrowers and contractors to apply with no impact to credit. Apply today! Even a loan with a low interest rate could leave you with monthly payments that are higher than you can afford. Some personal loans come with variable interest. When you need a large amount of money quickly, apply for an Installment Loan online or in store. Get approved in minutes for up to $15, Calculate new or used car loan payments with this free auto loan calculator. You can also estimate savings with our free auto loan refinance calculator. Our handy Personal Loan Calculator can help you calculate estimated monthly payments. The Personal Loan Calculator can give concise visuals to help determine what monthly payments and total costs will look like over the life of a personal loan. Your monthly payment for a personal loan will depend on the amount, term, and interest rate of the loan (which is highly dependent on your credit score). (The loan calculator can be used to calculate student loan payments, auto loans or to calculate your mortgage payments.) Jump to Calculator. Calculating. How much are the monthly payments for a $15, car loan? ; %, 1,, ; %, 1,, ; %, 1,, ; %, 1,, Need a $ loan fast? Acorn Finance is % free to borrowers and contractors to apply with no impact to credit. Apply today! Even a loan with a low interest rate could leave you with monthly payments that are higher than you can afford. Some personal loans come with variable interest. When you need a large amount of money quickly, apply for an Installment Loan online or in store. Get approved in minutes for up to $15,

Cash Loans Choose between $1, to $15, with payment plans that stretch up to 60 months.

For example, the payment on a $5, loan with a month repayment term (and an interest rate of %) is $ If you borrow $10, and take 75 months to. Need to estimate your loan payment amount? Use our easy loan calculator to quickly calculate the payment for any loan amount. Get started with TruChoice. Get an instant monthly payment estimate with TD's personal loan calculator. Just input your desired amount, rate and timeframe for a monthly payment. This loan payment calculator also doesn't account for additional mortgage-related costs, like homeowners insurance or property taxes, that could affect your. Try our Line of Credit & Loan Payment calculator now to estimate your minimum line of credit payments or installment payments on a personal loan. Calculate your next loan! Information and interactive calculators are made available to you as self-help tools for your independent use. Your payment is made by monthly direct debit from the account the loan is paid into. Your first payment will be made one month after issue of the loan on the. Loan amount: $15,; Interest rate: %; Loan term: 3 years. Check your results against ours: Monthly payment: $; Total interest. $15, Car Loan Calculator ; %, $, $ ; %, $, $ ; %, $, $ ; %, $, $ Compare loans from 37 lenders, right across the market. 1 We do the heavy lifting, so you don't have to. We work with a wide range of leading providers. Calculate your loan payments with our easy-to-use calculator. Get instant results and find out what your payments could look like. Use our personal loan calculator to estimate monthly payments for a Wells Fargo personal loan. But if you take out a $15, loan for seven years with an APR of 4%, your monthly payment will be $ Almost all personal loans offer payoff periods show. Interested in getting a personal loan? Use Upstart's loan calculator to get an estimate of your monthly payments and total interest costs. Go to your bank or credit union and ask the agent if you qualify for a loan and how much. The agent will check your FICO credit score and other obligations and. Where Can You Get a $15, Personal Loan? ; Achieve (formerly FreedomPlus), $10, to $50,, % to %, 60 months ; LendingClub, $1, to $40,, Loan Payment Calculator: $15, Loan at % Interest Rate ; lendingpoint · - % · $36, ; Lending Club · - % · $40, ; Upgrade · - %. This loan calculator allows you to easily see your monthly payments and total interest on a loan. Just put in the loan amount, loan term, and interest rate. Enter your amount to borrow from $1, to $50, The maximum loan amount for those who are not current U.S. Bank customers is $25, Use our auto loan payment calculator to estimate your monthly car loan payment based on your loan amount, rate and term $15,, 3, %, %, $, $.

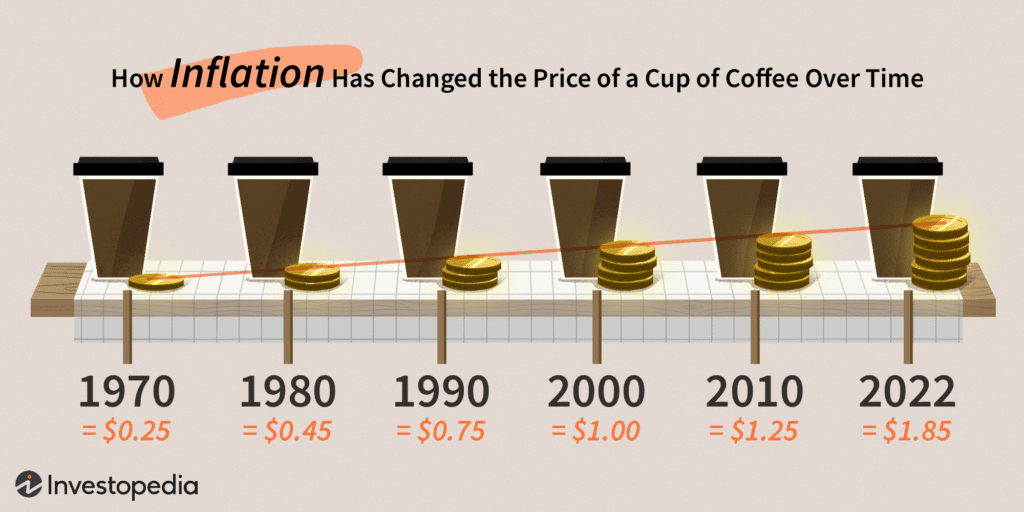

What Is An Inflation Hedge

Inflation hedging is a strategy for investing in assets that have a higher probability of keeping up with the rate of inflation, perhaps even generating returns. Real estate is an equity investment that can help balance, diversify and hedge your portfolio against inflation, while maximizing returns. An inflation hedge is an investment intended to protect the investor against—hedge—a decrease in the purchasing power of money—inflation. It feels like investors have been waiting for (and worrying about) higher inflation for decades, but it hasn't yet materialized. Gold protects investors against inflation because as their chosen currency devalues gold priced in that currency will tend to increase in price. The gold. Real estate can be considered a perfect hedge against inflation, under the strong assumption that future rent growth and discount rates move in line with. When limited only to financial assets, the energy equity sector provides the best potential inflation hedge, with positive inflation-adjusted return potential. Inflation hedge refers to an investment or asset that is expected to retain or increase its value over time, despite inflationary pressures in the economy. In. Inflation hedging is a strategy for investing in assets that have a higher probability of keeping up with the rate of inflation, perhaps even generating returns. Inflation hedging is a strategy for investing in assets that have a higher probability of keeping up with the rate of inflation, perhaps even generating returns. Real estate is an equity investment that can help balance, diversify and hedge your portfolio against inflation, while maximizing returns. An inflation hedge is an investment intended to protect the investor against—hedge—a decrease in the purchasing power of money—inflation. It feels like investors have been waiting for (and worrying about) higher inflation for decades, but it hasn't yet materialized. Gold protects investors against inflation because as their chosen currency devalues gold priced in that currency will tend to increase in price. The gold. Real estate can be considered a perfect hedge against inflation, under the strong assumption that future rent growth and discount rates move in line with. When limited only to financial assets, the energy equity sector provides the best potential inflation hedge, with positive inflation-adjusted return potential. Inflation hedge refers to an investment or asset that is expected to retain or increase its value over time, despite inflationary pressures in the economy. In. Inflation hedging is a strategy for investing in assets that have a higher probability of keeping up with the rate of inflation, perhaps even generating returns.

The Inflation Hedge Portfolio is a professionally selected unit investment trust which invests in exchange-traded funds (ETFs) which invest in real estate. The truth is that the yellow metal serves as an inflation hedge in the long run, but not in the short run. On this page · Building inflation protection into portfolios requires broad diversification across a number of asset classes and strategies. · Factors that. Real estate is often considered an inflation hedge because property values and rental rates can increase in response to inflation, but its effectiveness as an. A hedge against inflation includes assets that often outperform during inflationary times. Read how gold, real estate, and bonds are inflation hedges. As a result, hard assets are able to hold their value during periods of inflation. Real estate is one of the best hedges to inflation because it's impossible to. It feels like investors have been waiting for (and worrying about) higher inflation for decades, but it hasn't yet materialized. Gold is a proven long-term hedge against inflation but its performance in the short term is less convincing. Several assets can be looked to for protection against inflation, including: Index-linked gilts and TIPS. Discover 12 inflation-resistant investments in , including fine wine, gold, and commodities. We'll also explore how Vinovest can help you hedge against. An inflation hedge is an investment intended to protect against the decreased purchasing power of a currency. An inflationary hedge asset is expected to. The objective of this short study is to search for equity attributes that can be used to hedge against inflation by looking into the behavior of common factors. Inflation hedge. Browse Terms By Number or Letter: Investments designed to hedge against inflation and the loss of purchasing power associated with it. In our base case of persistently above-average inflation coupled with solid economic growth, we believe REITs should act as an effective hedge against inflation. “Stocks can be good as a long-term inflation hedge but can suffer in the short term if inflation spikes,” Arnott says. Consider market-tracking index funds that. What Is An Inflation Hedge? Inflation hedging typically involves investing in an asset whose price is expected to increase with inflation or if it offers a. 5 Tips for Hedging Against Inflation · 1. Real Estate Investment Trusts (REITs) · 2. Bonds and Equities · 3. Exchange-Traded Funds · 4. Gold and Gold Mining. In this article, we'll discuss the affect that inflation has on prices and real purchasing power and explain how to use real estate as a hedge against. Let's dive into inflation, how it's caused, and how farmland has historically protected investors against it. Real estate. Real estate is a well-known hedge against inflation. As the price of raw materials and labor goes up, new properties are more expensive to build.

What Is An Amazon Visa Card

Online shopping from a great selection at Credit & Payment Cards Store. The card also offers a $ bonus after spending $ on purchases in the first three months of account opening. There's a0% intro APR for the first 15 months. How you can earn points: You'll earn points on purchases of products and services, minus returns or refunds, made with a Prime Visa or Amazon Visa credit card. The Amazon Secured Card and Amazon Prime Secured Card, issued by Synchrony Bank, are unique credit cards each with two sets of features – the Secured Card. Buy now, pay later with equal monthly payments. Choose to earn rewards OR take advantage of 0% promo APR for 6 months on purchases of $50 or more or The Amazon Visa is a cash back card designed for people who shop on Amazon but don't have an Amazon Prime membership. If you do, you'll want to consider the. Prime Visa and Amazon Visa offer rewards on every purchase, both on and off clubname.ru Easily compare and apply online for a Amazon credit card with Visa. Find Visa credit cards with low interest rates, rewards and other benefits. Amazon Visa credit cards Earn rewards everywhere you shop, starting at clubname.ru Online shopping from a great selection at Credit & Payment Cards Store. The card also offers a $ bonus after spending $ on purchases in the first three months of account opening. There's a0% intro APR for the first 15 months. How you can earn points: You'll earn points on purchases of products and services, minus returns or refunds, made with a Prime Visa or Amazon Visa credit card. The Amazon Secured Card and Amazon Prime Secured Card, issued by Synchrony Bank, are unique credit cards each with two sets of features – the Secured Card. Buy now, pay later with equal monthly payments. Choose to earn rewards OR take advantage of 0% promo APR for 6 months on purchases of $50 or more or The Amazon Visa is a cash back card designed for people who shop on Amazon but don't have an Amazon Prime membership. If you do, you'll want to consider the. Prime Visa and Amazon Visa offer rewards on every purchase, both on and off clubname.ru Easily compare and apply online for a Amazon credit card with Visa. Find Visa credit cards with low interest rates, rewards and other benefits. Amazon Visa credit cards Earn rewards everywhere you shop, starting at clubname.ru

Credit and Payment Cards ; AMAZON VISA · 3% back at Amazon, Whole Foods Market, and on Chase Travel purchases or ; AMAZON STORE CARD · Amaxon Store Card: Get an. The Prime Visa earns 5% back at Amazon brands and on Chase Travel, an impressive return for a card without an annual fee. This is a great option for regular. Just not recommended. The only good thing about this card is the rewards, but besides that nothing else. I got stuck on the same limit for more than five. FM Mini Review: Not as compelling as the Prime Visa Card and, if you buy enough Amazon items to be interested in it, you should probably be a Prime member. Earn rewards whether you're shopping on clubname.ru, paying at the pump, or booking your next trip — all with no annual credit card fee. Plus, get an Amazon. Get to know Prime Visa. Earn unlimited daily rewards with no annual credit card fee or foreign transaction fees. This is a great card for Amazon, AWS, and Whole Foods purchases. Earning rate: Prime Members: 5% in Amazon rewards on US purchases at clubname.ru and Amazon. The Amazon Visa is a solid choice for earning points with no annual fee for those who shop on clubname.ru or at Whole Foods Market. It's icing on the cake if you. If you have an eligible Prime membership, you can upgrade your card to earn 5% back on purchases made at clubname.ru, Amazon Fresh, and Whole Foods Market. Prime Visa: An Amazon credit card The card comes with a $ intro bonus and as the name suggests, to open the card you'll need to have an Amazon Prime. Discover the benefits of various credit cards offered by Amazon, including the Amazon Rewards Visa Card, the clubname.ru Store Card. clubname.ru Credit Builder. Prime Visa offers cardmembers with an eligible Prime membership 5% back on purchases made at clubname.ru, Amazon Fresh, and Whole Foods Market. Online shopping for Equal monthly payments with Prime Visa and Amazon Visa from a great selection at Credit & Payment Cards Store. The amount listed in the promotional offer includes the 5% back you already earn on clubname.ru purchases with your Prime Visa card, and the extra % back you can. The Prime. Visa card account, which can earn more rewards than the Amazon Visa credit card account, is available to customers with an eligible Prime membership. In a nutshell, Amazon store cards are only for Amazon shopping, while Amazon Visa credit cards are traditional credit cards that you can use for payment. Card details · Get a $ Amazon Gift Card instantly upon approval exclusively for Prime members · Earn unlimited 5% back at clubname.ru, Amazon Fresh, Whole Foods. The minimum credit limit on the Amazon Prime Rewards Visa Signature Card is $, but your credit limit will depend on your credit score and income. You may. For the Prime Visa, you'll likely need a good credit score ( or above) to qualify. Having a good credit score does not necessarily guarantee you'll be. Amazon Rewards Visa Signature Cards is a rewards credit card that earns cash back for customers who shop at Whole Foods Market and clubname.ru

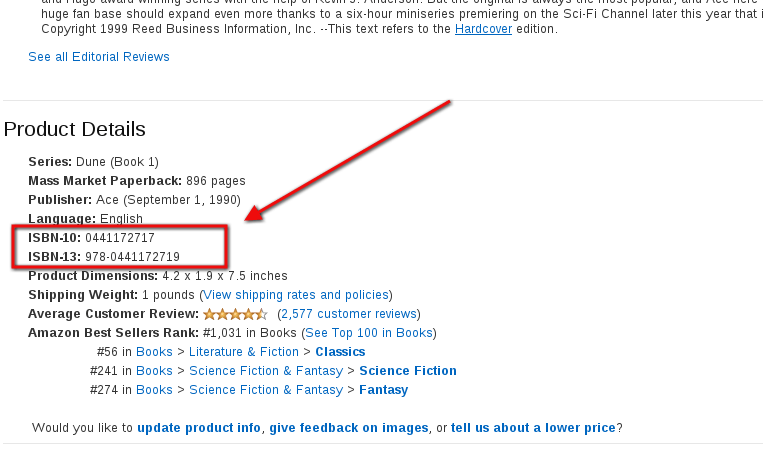

Ebook Isbn Download

Find books easily using ISBN, title, or author searches. Search using ISBN or ISBN Currently, calibre uses Google Books and Amazon. The metadata download can fill in Title, author, series, tags, rating, description and ISBN for you. To use the. You can get the ISBN from the publisher's website. Some sites that allow download of books have ISBN as the query field. audiobooks, videos, and music to watch or listen to on your smartphone, tablet, or computer. Many titles available for instant streaming or temporary download. Browse free books to read and download thousands of free eBooks in any genre for adults and kids of all ages. Download eBooks, audiobooks, music, and more! Explore Milwaukee Public Library's digital collection. Easy-to-use software compatible with today's popular. The most effective approach to downloading a LexisNexis eBook wirelessly to an Android device is to utilize the Dropbox application available for free. It's Google meets a top secret, modern card catalogue for eBooks! The best part? You don't even need a library card to access. 2 MILLION+ FREE BOOKS AND. Z-Library. The world's largest ebook library | b-ok z Ebooks 1 library. Find books Download Free Online books store on Z-Library. Find books easily using ISBN, title, or author searches. Search using ISBN or ISBN Currently, calibre uses Google Books and Amazon. The metadata download can fill in Title, author, series, tags, rating, description and ISBN for you. To use the. You can get the ISBN from the publisher's website. Some sites that allow download of books have ISBN as the query field. audiobooks, videos, and music to watch or listen to on your smartphone, tablet, or computer. Many titles available for instant streaming or temporary download. Browse free books to read and download thousands of free eBooks in any genre for adults and kids of all ages. Download eBooks, audiobooks, music, and more! Explore Milwaukee Public Library's digital collection. Easy-to-use software compatible with today's popular. The most effective approach to downloading a LexisNexis eBook wirelessly to an Android device is to utilize the Dropbox application available for free. It's Google meets a top secret, modern card catalogue for eBooks! The best part? You don't even need a library card to access. 2 MILLION+ FREE BOOKS AND. Z-Library. The world's largest ebook library | b-ok z Ebooks 1 library. Find books Download Free Online books store on Z-Library.

CONCEPTS OF BIOLOGY (FREE EBOOK DOWNLOAD) ; Publish Date: May 18, ; Print: ISBN ISBN ; Digital: ISBN WCPL offers a variety of sources and resources for accessing, downloading and enjoying e-books. Find out where to grab your next digital read and learn how. Start reading, listening or watching instantly with e-books, audiobooks, e-magazines, and streaming movies. Most titles are available online with just an. online or the user can download the e-book. By the early s, e-books ^ Brown, Bob (), The Readies, Rice University Press, ISBN. clubname.ru is the internet's #1 source for free eBook downloads, eBook resources & eBook authors. Read & download eBooks for Free: anytime! Some allow one user at a time or prevent book downloading. The transfer of eBooks between libraries is not usually allowed by publishers. If another library has. Z-Library. The world's largest ebook library | Ebooks library. Find books Download Free Online books store on Z-Library. Ebook Central should detect if you are coming from a laptop/desktop or mobile device and pre-select the appropriate option. Download process, step 1: choose. audiobooks, videos, and music to watch or listen to on your smartphone, tablet, or computer. Many titles available for instant streaming or temporary download. Paper List Price $ | ISBN: | “Impressive Winter has done an admirable job synthesizing many diverse sources into a tidy. Download Cengage Read for free. Cengage Read lets you study whenever and wherever you want with online and offline mobile access to your eBook. Download on. Open eBooks gives access to s of free ebooks for K students from participating schools. Find out how to get started. Download and Transfer of books between devices · A richer reading experience with EPUB 3 support · Searching eBooks · Accessibility · Go Multi-lingual · Bookmarking. clubname.ru e-Books Now DRM-Free! Plus, All Available e-Book Formats Available e-books can be downloaded instantly, with no shipping time or expense. You don't. The ISBN for a physical book is not the same as for an ebook. You usually search for the title and then find out what the ISBN is. Find the best free eBooks with your library card. Read books online or download them to your mobile device with our app. ISBNs, authors, or keywords using the general search bar. When you select “Open eBook” there will be options to download the full book content as a PDF file. ISBNs, authors, or keywords using the general search bar. When you select “Open eBook” there will be options to download the full book content as a PDF file. ISBN. (print) | (online). Open Access. Show contents. Download complete PDF. Creative Commons License · cover. German. Standard Ebooks is a volunteer-driven project that produces new editions of public domain ebooks that are lovingly formatted, open source, free of U.S.

Celsius Hodl Mode

HODL mode. The Celsius app allows its clients to enable HODL mode, which restricts them from accessing their funds. You guessed it, the only. The Celsius Network (CEL) and Binance are stopping customer withdrawals. Celsius But HODL Mode, it assured its users, was there solely to “. HODL Mode is a security feature that gives you the ability to temporarily disable outgoing transactions from your Celsius account. You control. There are various services for crypto lending; Celsius, BlockFi, Nexo etc. I pick XRP because of its utility as a mode of payment. I. The only consequence of the HODL mode is that it takes 24 hours to deactivate it, so it will only require you to wait for a day (after which it remains. Celsius °C; Farenheit °F. Aircraft speed. Knots. Knots; Km/h; Mph. Vertical speed / SYG. MODE S A. SERIAL NUMBER (MSN). AGE. © Hawkwind | Jetphotos A. Earn Rewards account holders can also manage their Earn Rewards accounts as long-term investments using the "HODL Mode" feature of their Celsius account. CelPay will not be available while in HODL mode. The HODL Mode feature on the Celsius wallet is one of my favorites. Many people who are just investing aren. I've tried inserting the public address I have when I deposit that coin into Celsius? - but no it does not like that! I do have HODL mode on and wonder if. HODL mode. The Celsius app allows its clients to enable HODL mode, which restricts them from accessing their funds. You guessed it, the only. The Celsius Network (CEL) and Binance are stopping customer withdrawals. Celsius But HODL Mode, it assured its users, was there solely to “. HODL Mode is a security feature that gives you the ability to temporarily disable outgoing transactions from your Celsius account. You control. There are various services for crypto lending; Celsius, BlockFi, Nexo etc. I pick XRP because of its utility as a mode of payment. I. The only consequence of the HODL mode is that it takes 24 hours to deactivate it, so it will only require you to wait for a day (after which it remains. Celsius °C; Farenheit °F. Aircraft speed. Knots. Knots; Km/h; Mph. Vertical speed / SYG. MODE S A. SERIAL NUMBER (MSN). AGE. © Hawkwind | Jetphotos A. Earn Rewards account holders can also manage their Earn Rewards accounts as long-term investments using the "HODL Mode" feature of their Celsius account. CelPay will not be available while in HODL mode. The HODL Mode feature on the Celsius wallet is one of my favorites. Many people who are just investing aren. I've tried inserting the public address I have when I deposit that coin into Celsius? - but no it does not like that! I do have HODL mode on and wonder if.

In most cases, HODL. Mode can be deactivated quickly by contacting Celsius Customer Care. • Celsius continues to process withdrawals without delay. We have. It means that Celsius is insolvent and all the investors who are staking on Celsius are in HODL mode and can't withdraw. This is literally. Item preview, Bitcoin ZEN MODE NFT designed and sold by DrunkGirlD Celsius CEL HODL Cryptocurrency Essential T-Shirt. By Joseph-Bryan. $ This is the most important difference and benefit between the Algorithmic Engineer that we use and the other crypto bots, we can sometimes decide to hold off on. Are we able to still send crypto into our wallets while in hodl mode, correct? After all, Celsius saves costs when people hodl, high transaction fees are paid. To clarify, HODL Mode is a security feature that gives you the ability to temporarily disable outgoing transactions from your Celsius account. 6. HODL #celsius #refinancing. 🎙️ Today's AMA will be happening in an Accessibility mode. Download document. Exit full screen. Ready to. HODL mode, 2FA, whitelisted addresses, biometrics (app only). Interest rates for lenders, Usually fixed: BTC from 3% to 6% (depending on your amount), ETH. Celsius has filed a lawsuit against Tether, seeking to reclaim 39, bitcoin valued at approximately $ billion. Three Arrows Liquidators are also suing. 63 people have already reviewed Celsius Network. Read about their experiences and share your own! celsius hodl mode Bnb Eth XRP crypto futures coinbase futures binance futures litecoin futures. WebWhat's HODL? 1 year ago. Updated. HODL started as a typo. people have already reviewed Celsius. Read about their experiences and share your own! | Read Reviews out of In most cases, HODL. Mode can be deactivated quickly by contacting Celsius Customer Care. • Celsius continues to process withdrawals without delay. We have. Item preview, Bitcoin ZEN MODE NFT designed and sold by DrunkGirlD Item preview, Celsius CEL HODL Cryptocurrency designed and sold by jacks-tees. HODL mode is a security feature that allows wallet assets to be locked for extended periods. Is There A Celsius Credit Card? Celsius plans to release a credit. Hodl - 7 hours ago. A Coinbase ecosystem memecoin is rallying after suddenly MODE; TROY; MAD; PTU; ACT; CATGIRL; MEOW; XCP; BNBX; LMR; XAVA; DPI; MNW; AURY. Webapp / Mobile app security: Celsius has one of the most user friendly web and mobile experiences. It is very easy to navigate. Celsius also offers HODL mode. Do you hold several cryptocurrencies? Use a combination of them to get a loan and get funds in USD or Stablecoin. Celsius HODL mode is a feature provided by Celsius Network that enables users to earn interest on their crypto holdings without having to worry about market. As I said, you're literally just freezing withdrawals from your own account, well done you HODL'er. You're HODL Mode squared now. I have no idea.

The App That Helps You Save Money

9. Qapital In addition to helping you create a budget and track your spending habits, Qapital rounds up every transaction you make to the nearest $2 and. Mint. Mint is a popular app that helps you track your expenses and manage your budget. · Acorns. Acorns is an app that helps you invest your spare change. · Honey. 11 Apps To Help You Save Money and Spend Smarter (Who Doesn't Want That?) · 1. Clarity Money · 2. Qapital · 3. Halfdollar · 4. Digit · 5. Truebill · 6. Budgt. Plum is an algorithm-based app that helps you save money and invest with minimal effort. The app also offers the option to save for your older age through its. Snoop is a free money management app, helping you track your spending, set budgets, cut your bills and control your finances. In the last few years, a few banks and fintech startups have taken this concept and modernized it with the introduction of smartphone apps that help you save. Best for the tech-savvy Qapital lets you set up various “rules” to automate savings. For example, you can set up the app so that every time you use your debit. Record your expenses · Include saving in your budget · Find ways to cut spending · Set savings goals · Determine your financial priorities · Pick the right tools. Copilot: Track & Budget Money. Spending, investing, net worth · Qapital: Set & Forget Finances. Save. Invest. · Honeydue: Couples Finance. Manage your money. 9. Qapital In addition to helping you create a budget and track your spending habits, Qapital rounds up every transaction you make to the nearest $2 and. Mint. Mint is a popular app that helps you track your expenses and manage your budget. · Acorns. Acorns is an app that helps you invest your spare change. · Honey. 11 Apps To Help You Save Money and Spend Smarter (Who Doesn't Want That?) · 1. Clarity Money · 2. Qapital · 3. Halfdollar · 4. Digit · 5. Truebill · 6. Budgt. Plum is an algorithm-based app that helps you save money and invest with minimal effort. The app also offers the option to save for your older age through its. Snoop is a free money management app, helping you track your spending, set budgets, cut your bills and control your finances. In the last few years, a few banks and fintech startups have taken this concept and modernized it with the introduction of smartphone apps that help you save. Best for the tech-savvy Qapital lets you set up various “rules” to automate savings. For example, you can set up the app so that every time you use your debit. Record your expenses · Include saving in your budget · Find ways to cut spending · Set savings goals · Determine your financial priorities · Pick the right tools. Copilot: Track & Budget Money. Spending, investing, net worth · Qapital: Set & Forget Finances. Save. Invest. · Honeydue: Couples Finance. Manage your money.

Explore a wide range of apps, from budgeting and couponing apps to cashback and investment apps, all designed to help you save more and spend wisely. Our guides. Five Ways Financial Apps Can Help You Make Smart Money Choices · Budgeting. If you struggle with budgeting, a smartphone app can make it easier than ever. Best money-saving apps · Overview: Best money-saving apps · Acorns · Oportun · Qapital · Also great · The competition · How we picked the best money-saving apps · Who. For most of us, keeping your savings separate from your checking account helps reduce the tendency to borrow from savings from time to time. If your goals are. Mint is a free budgeting app that tracks your bank accounts – spending, income, bills, and credit score. It makes note of your spending patterns and creates a. 1. Mint Mint is a free personal finance app that allows you to manage your money in one place. It connects to all of your bank accounts, credit cards, and. 9. Qapital In addition to helping you create a budget and track your spending habits, Qapital rounds up every transaction you make to the nearest $2 and. Emma is a money management app that's free to download on IOS and Android. It's an account aggregation tool that lets you connect all your bank accounts from. Turn on autopilot to save money without thinking about it. Rocket Money learns your habits and saves the right amount at the right time while helping you avoid. Open a zero-balance Savings Account online in under 3 mins! As a money management platform, Fi Money is the perfect solution for all your financial needs. Available to both Apple and Android users for just $1 a month, Acorns is essentially an investment app that does all the work for you. Acorns works by rounding. The good news: Using the negotiation service add-on to cut down on your monthly spending could help you cover the cost of a premium membership, as it charges a. Simplifi by Quicken is ideal if you love using a budget to plan — be it saving up for a vacation or tracking your retirement nest egg. At any time, you can. What makes Flipp one of the best savings apps on the market is that it amalgamates all your local weekly circulars into one easy-to-navigate site. It also shows. Plum*, - Autosave - Round-ups - Fee-free, 4% on its easy-access 'interest pockets' ; Chase*. - Round-ups - Fee-free, 5% – the total gets moved to another account. 1. Best Overall: You Need a Budget · 2. Best for Beginners: Simplifi and Tiller · 3. Best App for Investors: Empower · 4. Best for Debt Management: PocketGuard · 5. There are plenty of incredible apps that will help you save money, stay on budget, get out of debt, and spend your earnings more meaningfully. Most microsavings apps make small transfers from your checking account to a savings account. The most common feature is a round-up feature in which the app. Availability: iOS and Google Play. If you like to do shopping online, ShopBack can help you save money in the form of cashback deals from over 4, stores.

Best Place To Apply For Home Equity Line Of Credit

The best HELOC lenders · Best HELOC for high loan amounts: Flagstar Bank · Best HELOC for quick closing: Guaranteed Rate · Best for HELOCs with no closing costs. Here are some rules of thumb to spot and avoid dishonest lenders: Avoid a lender who wants you to apply to borrow more than the amount you need. Don't deal with. You can get a home equity line of credit (HELOC) at many banks, credit unions, and other lenders. Here's what to look for. A HELOC is a way to borrow money that works a lot like a credit card — you can access money when you need it, up to a certain limit. Your monthly payments are. A home equity line of credit is a great way to leverage the value of your home and ensure you have funds available when you need them, up to your line of credit. A home equity line of credit (HELOC) is a great way to get access to cash, especially when you're planning for major ongoing expenses, want to consolidate. PNC, NerdWallet's #1 HELOC lender for , is ideal for paying off credit cards, home renovations, mortgage refinance & allows you to lock a fixed rate. Get your personalized rate for a Home Equity Line of Credit up to $K with Citizens FastLine, the simpler, faster way to get a HELOC. 2: Complete a basic application. You can do this online after you're prequalified, by calling or by visiting a U.S. Bank branch. The best HELOC lenders · Best HELOC for high loan amounts: Flagstar Bank · Best HELOC for quick closing: Guaranteed Rate · Best for HELOCs with no closing costs. Here are some rules of thumb to spot and avoid dishonest lenders: Avoid a lender who wants you to apply to borrow more than the amount you need. Don't deal with. You can get a home equity line of credit (HELOC) at many banks, credit unions, and other lenders. Here's what to look for. A HELOC is a way to borrow money that works a lot like a credit card — you can access money when you need it, up to a certain limit. Your monthly payments are. A home equity line of credit is a great way to leverage the value of your home and ensure you have funds available when you need them, up to your line of credit. A home equity line of credit (HELOC) is a great way to get access to cash, especially when you're planning for major ongoing expenses, want to consolidate. PNC, NerdWallet's #1 HELOC lender for , is ideal for paying off credit cards, home renovations, mortgage refinance & allows you to lock a fixed rate. Get your personalized rate for a Home Equity Line of Credit up to $K with Citizens FastLine, the simpler, faster way to get a HELOC. 2: Complete a basic application. You can do this online after you're prequalified, by calling or by visiting a U.S. Bank branch.

Apply with our % online application in minutes and with funding in as few as 5 days. While traditional HELOCs usually have variable interest rates that can. Apply % online and quickly tap into your equity · Up to $, Home Equity Line of Credit · Available for primary, second, and investment homes · One Day. If you're looking for some help handling life's large expenses, a First American Home Equity Line of Credit (HELOC) from IL, FL and WI is a great solution. A HELOC allows you to withdraw funds as you need them, and you only pay interest on what you use. Have questions about the HELOC application process, payments. Best Home Equity Line of Credit Lenders · New American Funding · Farmers Bank of Kansas City · AmeriSave · First Federal Bank · Bethpage · CrossCountry Mortgage. Help spot potential signs of ID theft with 3-bureau credit file monitoring You need to have fairly good credit in order to qualify for most home equity loans. For loans under $,, a small community bank or credit union may offer the best deal. For larger loans ($, or more), talk to local and national banks. Ask your lender if there are any fees associated with your HELOC. There may be up-front fees, such as an application fee, an annual fee and a cancellation or. How to Apply for a Home Equity Loan or Line of Credit (HELOC) · Step 1. Understand Your Timeline · Step 2. Choose a Loan Type · Step 3. Gather Your Information. clubname.ru's home equity line of credit (HELOC) is an open-end product where a minimum draw amount of seventy-five percent (75%) or hundred percent (%) of. It's easy. It takes minutes to apply and decisions are quick. Plus, a dedicated loan officer will be there to answer all your questions. Based on our research, our top home equity loan lenders are Navy Federal, U.S. Bank and TD Bank due to their high max LTVs, competitive rates (as low as %). Borrow what you need, when you need it with a Home Equity Line of Credit. Navy Federal Credit Union has great rates available to our members. Use a home equity line of credit (HELOC) for your home projects. Access funds anytime for renovations, repairs, debt consolidation, large expenses or even. Get low rates & fast approval decisions on your SCCU home equity line of credit. Low initial draw requirements let you access your HELOC funds when you need. Its home equity loans offer competitive rates, flexible terms and a transparent lending process. All of these features combined make TD Bank our best overall. A home equity loan or FlexChoice Home Equity Line of Credit is a great way to up that credit score. What documents do you need to apply for a home equity loan. Make your home work for you by tapping into its equity. A Home Equity Line of Credit is a great way to fund home improvement or handle other big expenses. Answer a few questions online to help us assist you better. 2. Get paired with a dedicated loan officer. You'll be connected with an experienced SoFi Mortgage. Key Takeaways · You can get a home equity loan from a credit union, bank, or specialized lender. · A good home equity loan should have no or low fees, a low.

How Much Can You Afford In Mortgage

How much mortgage can I afford? Use the TD Mortgage Affordability Calculator to determine a comfortable mortgage loan and price range for your new home. A good rule of thumb is to take on a mortgage no more than 2 x your gross household income. So $k in your case. There will be a lot of. Use our mortgage affordability calculator to see how your interest rate, down payment and debt ratios affect your housing budget. Knowing what you can spend can bring you closer to finding and affording the home of your dreams. We've created a mortgage calculator to help you estimate your. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. What mortgage can I afford? The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much. How much home can you afford? Use the RBC Royal Bank mortgage affordability calculator to see how much you can spend and determine your monthly payments. You can get an estimate for this amount through a mortgage pre-qualification, or for more certainty, a mortgage pre-approval. A mortgage pre-qualification is a. Enter your monthly information: Gross Income $, Property Taxes $, Condominium Fees $, Heating Costs $, Borrowing Payments (eg credit cards, loans) $. How much mortgage can I afford? Use the TD Mortgage Affordability Calculator to determine a comfortable mortgage loan and price range for your new home. A good rule of thumb is to take on a mortgage no more than 2 x your gross household income. So $k in your case. There will be a lot of. Use our mortgage affordability calculator to see how your interest rate, down payment and debt ratios affect your housing budget. Knowing what you can spend can bring you closer to finding and affording the home of your dreams. We've created a mortgage calculator to help you estimate your. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. What mortgage can I afford? The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much. How much home can you afford? Use the RBC Royal Bank mortgage affordability calculator to see how much you can spend and determine your monthly payments. You can get an estimate for this amount through a mortgage pre-qualification, or for more certainty, a mortgage pre-approval. A mortgage pre-qualification is a. Enter your monthly information: Gross Income $, Property Taxes $, Condominium Fees $, Heating Costs $, Borrowing Payments (eg credit cards, loans) $.

To evaluate your maximum borrowing capacity, calculations are based on your down payment, the maximum mortgage debt ratios (32% for the GDSR note and 40% for. Use this mortgage calculator to estimate how much house you can afford. See your total mortgage payment including taxes, insurance, and PMI. Ideally, you don't want a mortgage payment – alongside any other recurring debts – to be more than 50% of your monthly income. It is also wise to have some. What percentage of your income should your mortgage be? There's a golden rule that you shouldn't spend more than 30% of your income on housing costs. That rule. Our Affordability Calculator offers a ballpark estimate of how much you'll be able to borrow — a first start in setting your expectations for buying a home. Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts. The 28% and 36% ratios are standard in the mortgage world, but lenders may have other combinations available, such as 33%/38%. Our affordability calculator will suggest a DTI of 36% by default. You can get an estimate of your debt-to-income ratio using our DTI Calculator. Interest rate. How much house can I afford based on my salary? Take account of your financial readiness to buy a house by applying the 28/36 rule. Lenders generally want to. Use PrimeLending’s home affordability calculator to determine how much house you can afford Things that impact how much mortgage you can afford include. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. No more than 30% to 32% of your gross annual income should go to mortgage expenses, such as principal, interest, property taxes, heating costs and condo fees. To get a rough estimate of what you can afford, most lenders suggest you spend no more than 28% of your monthly income — before taxes are taken out — on your. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. If you have significant credit card debt or other. The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. For example, some experts say you should spend no more than 2x. Use our home affordability tool to estimate how much house you can afford considering closing costs, mortgage, and additional fees and taxes. Calculate how much house you can afford using our award-winning home affordability calculator. Find out how much you can realistically afford to pay for. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea of. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current.

401k For Home Purchase

There's no specific penalty exemption for home purchases when you pull money out of a (k). If you leave your company, you may be required to pay back the. When taking a (k) loan, you can generally borrow the lesser of 50% of your vested balance or $50, Vesting refers to the process of how you gain ownership. Yes it is. You don't have to put down 10%. First time home buyers can do 3% down. Yes, you can withdraw from a K for a first time home purchase. First-time homebuyers have the option to withdraw up to $10, from their k with no. No, withdrawing funds from your k for a down payment on a house and experiencing a failed home purchase will not typically result in criminal charges. It is. More In Retirement Plans Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan. You can borrow up to $50, or half of the value of the account, whichever is less, as long as you are using the money for a home purchase.4 This is better. If you had K in your account, you might be able to purchase the house with the funds in the (K) and then the (K) would own the house. One way to access funds for a home down payment is through a (k) withdrawal. You take money directly from your (k) retirement plan under specific. There's no specific penalty exemption for home purchases when you pull money out of a (k). If you leave your company, you may be required to pay back the. When taking a (k) loan, you can generally borrow the lesser of 50% of your vested balance or $50, Vesting refers to the process of how you gain ownership. Yes it is. You don't have to put down 10%. First time home buyers can do 3% down. Yes, you can withdraw from a K for a first time home purchase. First-time homebuyers have the option to withdraw up to $10, from their k with no. No, withdrawing funds from your k for a down payment on a house and experiencing a failed home purchase will not typically result in criminal charges. It is. More In Retirement Plans Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan. You can borrow up to $50, or half of the value of the account, whichever is less, as long as you are using the money for a home purchase.4 This is better. If you had K in your account, you might be able to purchase the house with the funds in the (K) and then the (K) would own the house. One way to access funds for a home down payment is through a (k) withdrawal. You take money directly from your (k) retirement plan under specific.

How Much of Your k Can Be Used for a Home Purchase You can typically borrow up to half of the vested balance of your k, or a maximum of $50, Most. Some people may choose to tap their retirement balances for down payment money through a (k) loan or early withdrawal. home purchase. Any amount exceeding. When taking a (k) loan, you can generally borrow the lesser of 50% of your vested balance or $50, Vesting refers to the process of how you gain ownership. Repayment terms · A copy of your home purchase agreement signed by you and the seller, including the closing date and balance of the purchase price, or · A. The funds in your (k) retirement plan can be tapped for a down payment for a home. You can either withdraw or borrow money from your (k). structure of the home. ❑ If your home is covered by insurance, you must submit ✓ Purchase agreement or sales contract (signed by buyer and seller). If you had K in your account, you might be able to purchase the house with the funds in the (K) and then the (K) would own the house. Because the money needed for a down payment is not always easy to come by, lenders of all types allow borrowers to apply money from a K loan to their down. Taking a loan from your k or borrowing from You can borrow against the value of your home with a home equity loan or home equity line of credit. Alternatives to withdrawing or borrowing from your (k) early · Home equity loan or line of credit · Personal loan · Loan Management Account® from Bank of. Unlike IRA's which waive the 10% early withdrawal penalty for first time homebuyers, this exception is not available in (k) plans. When you total up the tax. Can a (k) be used for a home purchase? The simple answer is that yes, the money in an employer-sponsored tax-deferred (k) account can be used to buy a. The biggest downside to using money from your (k) for a home purchase is that it significantly diminishes your retirement savings. Even if you pay back the. Loans from a (k) are limited to one-half the vested value of your account or a maximum of $50,—whichever is less. However, even though you're borrowing. Under these rules, a person who has not owned a home that they have lived in during the prior two years may withdraw up to $10, from their IRA without having. Essentially, reducing retirement savings because you're buying a very expensive house may leave you worse off in the long run. But reducing contributions so. Check any restrictions on how you can use the loan, such as only for education expenses, mortgage payments or medical expenses. Typically, (k) plans cap. Can a (k) be used for a home purchase? The simple answer is that yes, the money in an employer-sponsored tax-deferred (k) account can be used to buy a. For instance, when purchasing a property with a k, any income generated from that property will not be taxed. Instead, the income is put directly into the.

1 2 3 4 5 6